As the global epidemic continues, streaming media platforms are making history.

With “CODA” becoming the first streaming movie to win the Oscar for Best Picture, streaming movies finally “come into the house” and gain mainstream recognition.

“CODA” is produced by Apple TV+, a streaming media platform under Apple that has been established for less than three years, and finally beat many competitors including the world’s largest streaming media platform Netflix.

Under the epidemic, offline theaters have been severely impacted, and global box office revenue has been halved. Correspondingly, it is the increased investment and rapid growth of the world’s major streaming media platforms.

Among them, there are not only traditional Hollywood film giants such as Disney and Warner Bros., but also technology companies such as Amazon and Apple to “join in the fun” and jointly shake the status of the streaming media “big guy” Netflix.

Before Apple TV+ won the award, Netflix had hit the Olympics several times and won several awards except “Best Picture”. But in the end, the “breakthrough” feat of streaming movies at the Oscars was first completed by the “underachiever” Apple without movie genes.

Under the slowdown of Netflix’s growth, can Apple, which only entered the game in November 2019, take advantage of the Oscars to become the leader of the new generation of streaming media platforms?

Related Post: Netflix considers introducing ad plans with lower subscription prices.

Apple that came from behind

Since 2014, Netflix has embarked on a journey to hit the Oscars, and during this period, it has spared no expense to seek original film cooperation with famous Hollywood directors.

Over the years, films produced by Netflix have been nominated for 116 Oscars and won 16 of them.

The closest Netflix came to the Oscar for Best Picture was when its original film “Roma” was nominated for an Oscar in 2019 with 10 nominations.

At that time, this highly-voiced film was considered to be very likely to win the Best Picture Award for the first time on behalf of a streaming media work.

Although “Roma” unfortunately lost to “Green Book” in the end, Netflix’s strength in content creation cannot be underestimated and has been widely recognized by the industry.

Netflix’s “The Power of the Dog” is also a contender for best picture at this year’s Oscars.

The film has not only been nominated for 12 Oscars, but has also won many iconic international awards including the Golden Globe Award, British Academy Film Awards, Critics’ Choice Film Awards, and American Film Institute Awards.

In contrast, the film “CODA” produced by Apple TV+ did not perform so well.

In 2021, Apple picked up the film at the premiere of the Sundance Film Festivel and paid $25 million for the distribution rights, the highest price ever paid for a film at the festival.

Due to the impact of the epidemic, this small-budget film with a production cost of less than $10 million was only released on a small scale in some theaters in the United States, and was subsequently launched on the Apple TV+ platform.

In various Oscar season outposts, “CODA” was mediocre and too “quiet.”

It was not until March 19 that the film unexpectedly won the highest award of the “American Producers Guild Award”, which is regarded as one of the barometers of the American film industry, which made the competition for the best picture at this year’s Oscar a little suspenseful.

According to “The New York Times” report, in order to impact the Oscars, Apple and Netflix have launched active publicity activities.

Apple spent between $20 million and $25 million in advertising for “CODA”, which cost only $10 million, while Netflix is expected to spend more than $30 million for “The Power of the Dog”.

The final result of this year’s Oscars may have made many Netflix fans sigh.

But in fact, Apple TV+’s “come from behind” is more of an accident than the inevitable result of its long-term investment in content.

Under the epidemic, streaming media accelerates its rise

As early as 2017, streaming films have begun to fight for the best picture Oscar, but they have been questioned by mainstream filmmakers.

That year, Amazon Prime Video was nominated for several Oscars for the film “Manchester by the Sea”, which was also purchased at Sundance Film Festivel, and finally won the Best Actor and Best Original Screenplay, but failed to win the most important “Best Film” award.

In recent years, streaming media platforms such as Netflix and Amazon Prime Video have shown strong interest in the Oscars, and they hope to take the lead in achieving breakthroughs in the Oscars by producing or acquiring good films.

But just imagining the scene of a streaming movie winning awards has made many senior filmmakers “unacceptable”.

Spielberg, a famous director, has publicly stated that Netflix’s works should appear on the Emmy Awards (the highest award in the American television industry) and are not eligible for the Oscars.

Some traditional film studios are of the same opinion.

In 2019, Netflix’s “Roma” came close to winning Best Picture, much to their dismay.

They argued that “Roma” not only overspend on the PR campaign, but was only released in a limited number of theaters for just three weeks.

“Roma” didn’t release box-office figures and didn’t follow the rule that films must be in theaters for 90 days before they can be streamed online.

The epidemic sweeping the world has changed this situation to some extent.

The bleak offline box office and the closure of a large number of theaters caused by the epidemic have directly promoted the transformation of movies to online streaming media, and streaming media platforms have ushered in a period of rapid development.

A keynote report released by the Motion Picture Association of America shows that in 2021, global box office revenue will increase from $11.8 billion in 2020 to $21.3 billion, an annual growth rate of 80.5%.

Still, box office revenue in 2021 is only about half of the $42.3 billion in pre-pandemic 2019 revenue.

Even AMC, the world’s leading theater chain, was once on the verge of bankruptcy, with a cumulative loss of $6 billion in the past two years.

In contrast, it is the rapid growth of the number of subscriptions to global streaming media platforms.

As consumers spend significantly more time at home, people tend to opt for home video consumption.

So far in 2019, the number of subscribers to online video services worldwide has grown from 864 million to 1.3 billion.

In addition, as streaming platforms reach a wider overall audience, the number of users subscribing to multiple platforms at the same time has grown significantly.

According to a streaming video research report released by market research consultancy Mintel, the share of users using five or more subscription video-on-demand (SVoD) services has more than quadrupled since 2019.

Streaming is projected to account for half of all U.S. TV viewing by 2024.

With the rapid development of major streaming media platforms, the market structure is constantly changing.

Around 2020, the streaming market once dominated by Netflix, Amazon Prime Video and Hulu is being disrupted as major Hollywood studios and tech giants such as Apple launch their own streaming platforms.

Among them, Disney+, a streaming media platform launched by Disney in November 2019, has a particularly impressive growth rate.

According to Disney’s official original plan, Disney+ will have 60 million to 90 million subscribers in 2024.

The reality is that it took Disney+ just over 8 months to achieve its goal of attracting 60 million paying subscribers.

By the end of last year, Disney+ users had exceeded 120 million. Its latest 2024 goal is to achieve 260 million users.

Disney+’s market share is also increasing.

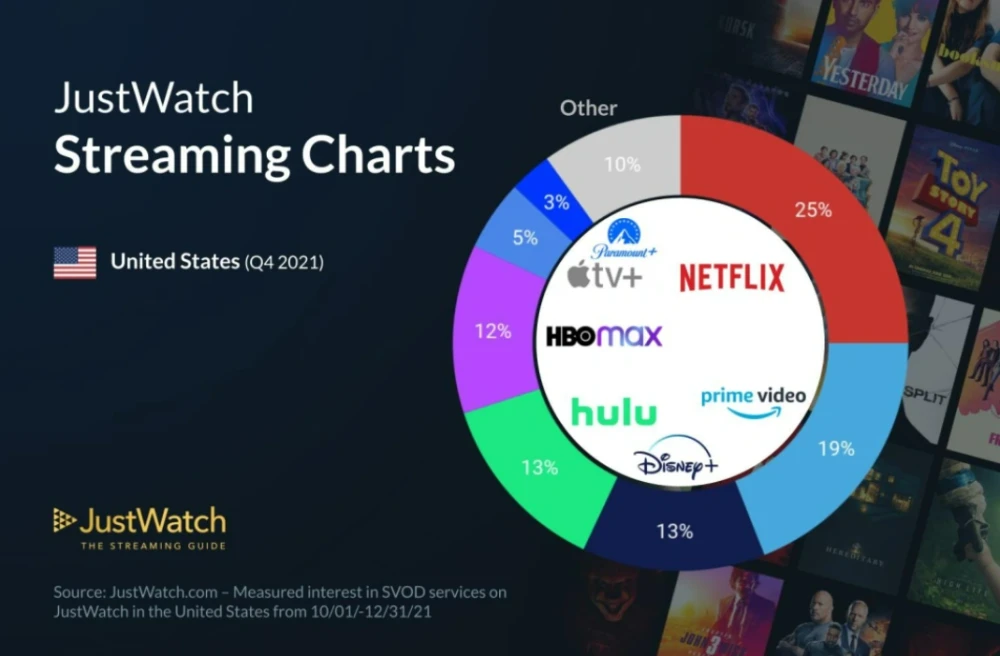

JustWatch data shows that in the fourth quarter of last year, Disney+ has reached 13% of the U.S. market, on a par with Hulu, Amazon Prime Video and Netflix.

In order to seize the growth dividends of streaming media brought about by the epidemic, and to seize a larger user market in the face of fiercer competition, major streaming media platforms with strong financial resources have increased their investment in recent years.

Last year, Amazon acquired Hollywood studio MGM for more than $8 billion. In the future, classic films such as “007” may appear on the Amazon Prime Video platform.

In 2022, Netflix expects to spend more than $17 billion on content, a 25% increase from 2021 and a 57% increase from 2020.

Morgan Stanley predicts that Disney’s investment in streaming content could grow 35% to 40% year over year. The annual content budget of Apple TV+ has also increased from the original $1 billion to the current $6.5 billion.

Under the special circumstances of the spread of the epidemic, Oscar has allowed participating films to skip the theater release step for two consecutive years and directly participate in the final award competition.

The attitude of Hollywood directors to streaming media platforms is also changing. In June last year, Spielberg’s production company struck a multi-year deal with Netflix to make movies.

Spielberg said in a statement, “It is now very clear that we have such a great opportunity to imagine new stories together and reach a wider audience in new ways.”

Half of the 10 films nominated for Best Picture at the Oscars this year came from streaming platforms or achieved simultaneous premieres in offline theaters and online platforms.

How long can Apple TV+ be popular?

The halo brought by the Oscar for Best Picture brought Apple TV+ into the mainstream. Benefiting from this, the number of subscribers to Apple TV+ may increase significantly in the short term, and Wall Street has also given a higher target price for Apple.

Moreover, compared with the slowdown of Netflix in recent years, Apple TV+ is still in a growth period.

According to JustWatch data, Apple TV+ will increase its market share by 2% in 2021, surpassing Peacock, the streaming platform owned by the US NBC Universal Group, and will soon surpass Warner’s HBO Max.

Revenue from Apple’s services business, which includes revenue from Apple TV+ subscriptions, rose about 24 percent to $19.5 billion in the fourth quarter of last year.

Toni Sacconaghi, an analyst at investment research firm Bernstein, said Apple TV+ revenue nearly doubled year-over-year in fiscal 2021 and is estimated to have risen to $2.2 billion.

Even so, there’s a considerable gap between Apple TV+ and what’s truly “mainstream.”

In terms of market share, as of February this year, Apple TV+ had only about 5 percent of the U.S. market, far less than Disney+’s 13 percent, Amazon Prime Video’s 19 percent, or Netflix’s 25 percent.

In terms of the scale of paying users, Netflix has more than 200 million global users, and Disney+ has more than 100 million users.

Although Apple does not disclose the number of users of Apple TV+, according to The Information, it has 40 million accounts and 20 million paying users worldwide, which is not yet at the same level as Netflix and Disney+.

From the perspective of the most core platform content, compared with platforms such as Netflix and Disney+ that have accumulated a large number of original film resources, Apple TV+, which started late, has chosen the “less but refined” route, and there are fewer choices of classic movies on the platform. .

However, because a lot of resources have been invested in the production of original movies, many wonderful original works can still be seen on Apple TV+.

In addition, Apple TV+ has the lowest price compared to other streaming platforms.

At $4.99 a month, it’s a lot cheaper than Disney+’s $7.99 monthly fee, or Netflix’s lowest monthly fee of $9.99.

These factors may all help Apple TV+ achieve market share gains in the short term. But owning a hit show doesn’t guarantee the continued success of a streaming service in the long run.

As the popularity of award-winning films fades, Apple TV+ will soon be “returned to its original shape” if it cannot effectively improve the quantity and quality of original content.

High-profile content helps attract a lot of new users, but only half of those users stick with paying for at least six months, according to data analysis by big data research firm Antenna.

Previously, Antenna’s data showed that Apple TV+ loses one-tenth of its users every month, and user retention has become the most prominent problem on the platform.

Julia Alexander, senior strategist at Parrot Analytics, said: “To make Apple TV+ a truly viable product, consumers will be willing to pay $5 a month for it, or bundle the apps they really want to open. , its value proposition has to be much better than it is currently.”